SMSF - Super contributions and pension withdraws

As we approach the conclusion of another financial year, we would like to provide you with some important reminders to ensure that your SMSF is prepared for June 30, 2024.

Contributions MUST BE received by the fund to count for this financial year.

Be mindful of payment processing dates over the weekend, allow 3-5 days for funds to clear.

Minimum Pension Requirements

PLEASE ENSURE YOU HAVE MET YOUR MINIMUM PENSION OBLIGATIONSFOR THE 2024 FINANCIAL YEAR

Failure to meet the minimum pension requirement will result in SMSFs being taxed at a rate of 15% on pension investments, rather than enjoying tax-free status.

Please be reminded that pension payments must be withdrawn in cash (i.e., they cannot be made in-specie) and should be completed by June 30.

If you have been receiving regular pension payments, it is possible that you have received an amount exceeding the minimum payment required for this year. It is important to note that unless you meet the contribution eligibility rules, these excess funds cannot be refunded or returned.

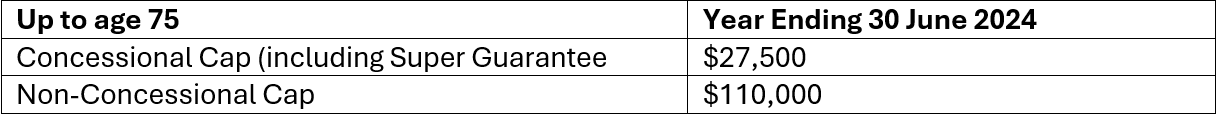

Contribution Caps for 2023-24

Contributions are only counted to the fund if they are received by 30 June.

Prior to June 30, 2024, it is advisable to review your contribution strategies to confirm that you have made the intended contributions and to ensure that they fall within the contribution caps.

If you are over 67 and wish to make personal concessional contributions you will need to meet the work test

Starting from July 1, 2023, the work test, which entails being gainfully employed for a minimum of 40 hours over a consecutive 30-day period. You have the flexibility to fulfill this test at any point during the financial year.

Carry forward concessional contribution caps

Individuals have the opportunity to make extra concessional contributions by utilizing their unused concessional contribution caps from previous years on a rolling basis over a period of five years. However, this is only applicable if their Total Super Balance was below $500,000 as of June 30, 2023. This can be useful if you have larger than usual income in a financial year.

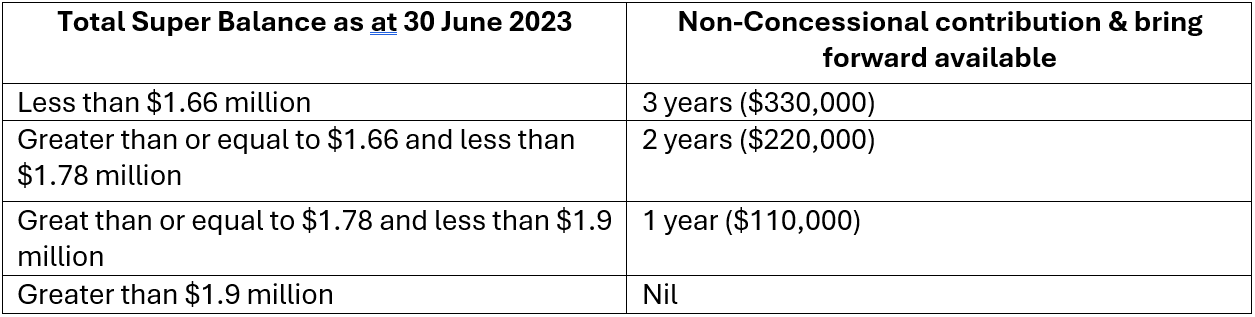

Non concessional contributions – bring forward arrangements

Members under the age of 75 on 1 July 2023 may ‘bring forward’ two years of non-concessional contributions subject to their Total Super Balance on 30 June 2023.

If you need to discuss your contributions or withdrawals with me prior to 30 June, please book a meeting with me online using the below link:

David Barker

SMSF Specialist