2024-25 Federal Budget

On Tuesday 14 May 2024, Treasurer Dr Jim Chalmers handed down his third budget since being elected, and forecasts a ‘back-to-back’ surplus.

The 2024-25 Federal Budget contained a wide range of tax related measures, with a focus on support for small businesses, cost of living relief, superannuation, tax cuts, as well as monitoring and potentially reducing inflation.

Below we summarise the budget, breaking down the key insights for individuals and businesses.

INDIVIDUALS

Australians keeping more of what they earn

From 1st July 2024, the Government will be delivering tax cuts for Australian taxpayers to help ease cost-of-living pressures.

It is also expected that the rate at which employers deduct Pay-As-You-Go (PAYG) withholding amounts may be adjusted to take into account the revised tax rates from salary and wage payments. From 1 July this year, the Government will:

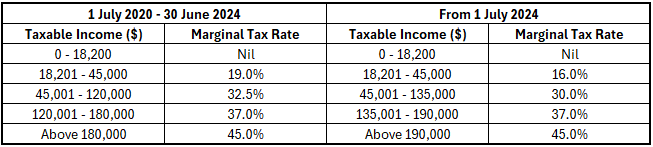

• Reduce the 19% tax rate to 16 per cent

• Reduce the 32.5% tax rate to 30 per cent

• Increase the income threshold above which the 37% tax rate applies from $120,000 to $135,000

• Increase the income threshold above which the 45% rate applies from $180,000 to $190,000.

Income tax rates for Australian tax residents

Returning bracket creep

The Government’s tax cuts will average tax rates for taxpayers and will offer safeguarding against bracket creep, particularly benefiting low-to-middle-income earners, and support the progressive nature of the tax system. It is estimated that 6.5 million taxpayers will receive tax cuts, averaging approximately $1,650 per year. This measure aims to enhance financial incentives for employment and promote greater participation in the workforce.

Increasing the Medicare levy low-income thresholds

The Government confirmed its increases to the Medicare levy thresholds which was originally announced on 25th January 2024. For the 2023–24 income year, the Government has increased the Medicare low-income thresholds, ensuring that over one million low-income taxpayers remain exempt from the Medicare levy or pay a reduced rate.

Changes to HECS/HELP Loans

Changes to student debts were announced in the Budget to assist those with student debts under the Higher Education Loan Program (HELP).

From 1 June 2023, changes will be made to the indexing of HELP loans, where either the Consumer Price Index (CPI) or the Wage Price Index, whichever is lower, will be used for indexation as opposed to HELP loans being solely indexed by CPI.

This adjustment will affect compulsory repayments made through the tax system when repayment income exceeds the minimum repayment threshold. The ATO will automatically adjust outstanding HELP loan balances indexed on 1 June 2023, and/or 1 June 2024, and will apply any resulting credit to the individual’s HELP account.

SUPERANNUATION

Superannuation Guarantee Entitlements

From 1 July 2024, the Super Guarantee rate will increase to 11.5%. It will continue to increase by 0.5 per cent on 1 July each year until it reaches 12% in 2025.

Subject to legislation, from 1 July 2026, employers will be required to pay their employees’ superannuation guarantee entitlements on the same day that they pay salary and wages.

Superannuation payments for Paid Parental Leave (PPL)

The budget has allocated $1.1 billion to pay superannuation on Government-funded Parental Leave. The budget announced the intention to pay 12% on superannuation paid on Commonwealth government-funded PPL for births and adoptions on or after 1 July 2025.

SMALL BUSINESSES

The Government has revealed incentives to navigate small businesses through challenges and create economic conditions which will assist small businesses to invest, innovate and generate new jobs that will benefit Australian communities.

Small Business Support - $20,000 instant asset write-off

Small businesses, with an aggregated turnover of less than $10 million, will be eligible for the $20,000 instant asset write-off for an additional year. This will allow small businesses to immediately deduct eligible depreciating assets costing less than $20,000 that are first used/ installed ready for use by 30 June 2025. From 1 July 2025, the asset cost threshold will return to $1,000. The $20,000 threshold will be applied on a per asset basis, allowing small businesses to instantly deduct the cost of multiple assets.

Assets which cannot be immediately deducted (valued at $20,000 or more), can continue to be included in the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% income year thereafter.

Powering innovation

The Government has detailed their focus on eInvoicing, which is aimed to enhance cash flow, disrupt payment redirection scams and improve productivity for small businesses.

The Treasurer announced that funding will be allocated to assist businesses in developing and safely using responsible artificial intelligence (AI).

Other Relevant Measures

The Government will no longer proceed with the 2019-20 Budget measure to improve the Australian Business Number (ABN) regulatory issues as the ATO will be implementing enhanced administrative processes relating to this.

The ATO will be provided with additional funding to introduce compliance programs which will assist in mitigating tax and superannuation fraud from 1st July. Tax Law will be amended to allow the Commissioner of Taxation discretion to not use a taxpayer’s refund to offset outstanding tax debts where the Commissioner has put that old tax debt on hold prior to 1 January 2017. This is only applicable to individuals, small businesses and not-for-profits only.