Federal Budget 2023/2024

On the 9th May 2023, treasurer Jim Chalmers delivered the latest Federal Budget.

Kamper has summarised the Budget below, breaking down the key insights for businesses and individuals.

BUSINESSES

SMALL BUSINESS INSTANT ASSET WRITE-OFF THRESHOLD

Date of effect: 1 July 2023 - 30 June 2024

Eligible businesses with a turnover of less than $10 million will be able to immediately deduct the full cost of eligible assets costing less than $20,000. The $20,000 threshold will be applied on a per asset basis.

Temporary full expensing is applicable until 30th June 2023. From 1 July 2023 to 30 June 2024, the instant asset write-off threshold will be $20,000.

The 2022-23 income year is the final year where entities can carry-back losses to prior years.

SMALL BUSINESS ENERGY INCENTIVE

Date of effect: 1 July 2023 - 30 June 2024

This scheme will be introduced to businesses with annual turnover of less than $50 million to enable them to claim an additional 20% deduction on the cost of eligible depreciating assets that support electrification and more efficient use of energy.

FRINGE BENEFITS TAX (FBT)

The FBT exemption for electric cars will continue, but the exemption for plug in hybrids will be phased out from 1 April 2025. Eligible small businesses may be entitled to a one- off $650 offset off their energy bill.

ATO DEBT RECOVERY OF UNPAID TAX AND SUPER

Additional funding will be provided from 1 July 2023 to assist the ATO’s engagement with taxpayers to ensure tax and super liabilities are paid on time.

ATO COLLABORATION WITH SMALL BUSINESSES

Date of effect: From 1 July 2023

Who’s affected: Businesses with annual turnover up to $50 million

Funding will be given to the ATO to lower the tax related administrative burden for small businesses. Tax clinics will be established from 1 January 2025 to improve accessibility to tax advice and assistance for small businesses.

A trial of ATO independent review processes will be available to businesses (with turnover between $10 million and $50 million) who are subject to an ATO audit from 1 July 2024 to 31 December 2025.

SMALL BUSINESS LODGEMENT PENALTY AMNESTY

For small businesses with turnover of less than $10 million, there will be a lodgement penalty amnesty that will remit failure-to-lodge penalties for outstanding tax statements lodged within the period 1 June 2023 to 31 December 2023 that were originally due between 1 December 2019 to 29 February 2022. This will encourage small businesses to re-engage with the tax system who are behind with their lodgements.

SMALL BUSINESS SUPPORT - HELPING SMALL BUSINESS MANAGE THEIR TAX INSTALMENTS

Date of effect: 1 July 2023

Who’s affected: Small businesses eligible to use the relevant instalment methods

For the 2023-24 financial year, the GDP Adjustment Factor for PAYG and GST instalments will be reduced from 12% to 6%. The reduced GDP adjusted rate will be applied to small businesses and individuals with less than $10 million turnover for GST Instalments and less than $50 million turnover for PAYG Instalments. This incentive is targeted towards asset renewal and to provide cash flow support.

SUPERANNUATION CHANGES

Date of effect: 1 July 2023

Who’s affected: Employee’s receiving & employers paying Superannuation Guarantee Contributions

The Superannuation Guarantee rate increase as below:

• 11%: 1 July 2023 – 30 June 2024

• 11.5%: 1 July 2024 – 30 June 2025

• 12%: 1 July 2025 – 30 June 2026

From 1 July 2025, the Government confirmed its intention to implement an additional 15% tax on total superannuation balances exceeding $3 million.

From 1 July 2026, the Treasurer has introduced the “Payday Super” scheme which will require the timing of payment of superannuation contributions to be aligned with the timing of the payroll.

INDIVIDUALS

DISCONTINUATION OF LOW TO MEDIUM INCOME TAX OFFSET

Date of effect: 2022/23 Tax Year

Who’s affected: Income earners up to $126,000

One of the significant decisions made during the Budget was to not extend the low-and middle-income tax offset (LMITO) beyond its planned cessation date of the 2021/22 financial year. The LMITO was introduced in 2018 as a temporary provide tax relief for low and middle-income earners. It provides a tax offset of up to $1,500 for individuals with a taxable income of up to $126,000.

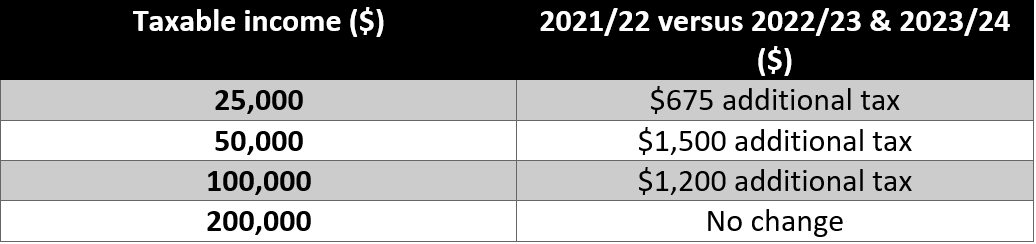

This table below shows a comparison of the tax paid in 2021/22 vs 2022/23 and 2023/24 at a variety of income levels.

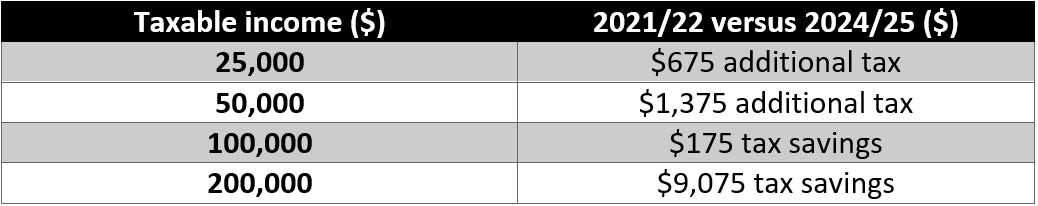

This table below shows the consolidation of the removal of the tax offset and then new proposed tax brackets in 2024/25.

MEDICARE LEVY LOW-INCOME THRESHOLDS

Date of effect: 1 July 2022

Who’s affected: Singles, families and pensioners under the thresholds

Starting from July 1 2022, the Medicare levy low-income thresholds will be adjusted to reflect changes in the Consumer Price Index (CPI) for singles, families, seniors, and pensioners. The updated thresholds are as follows:

STAGE 3 PERSONAL INCOME TAX RATES AND THRESHOLDS

Date of effect: 1 July 2024

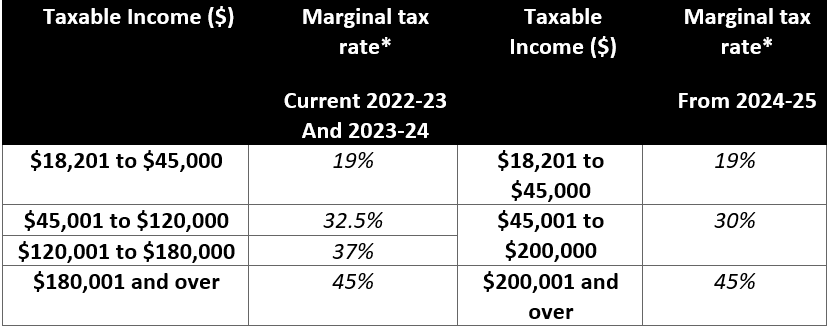

The former government legislated three stages of personal income tax cuts commencing from the 2019 financial year, with stage 3 of these tax cuts due to take effect on 1 July 2024. The budget announcement confirmed that the stage 3 tax cuts will change the income tax rates and thresholds (for resident taxpayers) scheduled to take effect from 1 July 2024.

For a comparison between current income tax rates and the changes that will occur under the stage 3 measures, refer to the table below.

* The above rates do not include the Medicare Levy of 2%

OTHER TAX MEASURES

Additional funding will be allocated to the Australian Taxation Office (ATO) and the Treasury to enhance efforts in targeting and ensuring compliance

Increase in the tax on tobacco by five per cent per year for the next three years (above standard indexation increases).

A national anti- scam centre will be established to respond to the spike in online scams & fraud

There will be a decrease in the Fuel Tax Credit available for on-road heavy vehicles.